The SIV shown on the front screen is the lowest price that you can sell a vehicle for without the dealer losing money.

This doesn't necessarily bear any immediately logical resemblance to the actual accounting Stand-in-Value. The reason for this is often due to preparation and other costs incurred on the vehicle after it has been purchased which whilst add to the SIV, do not reduce the profit from a margin VAT perspective.

An extreme example is shown below. A customer has part exchanged a vehicle for significantly less than it's actual worth due to a large amount of work required on it. The dealer has carried out this work which has added £2500+ to the original Purchase Price of £1000.

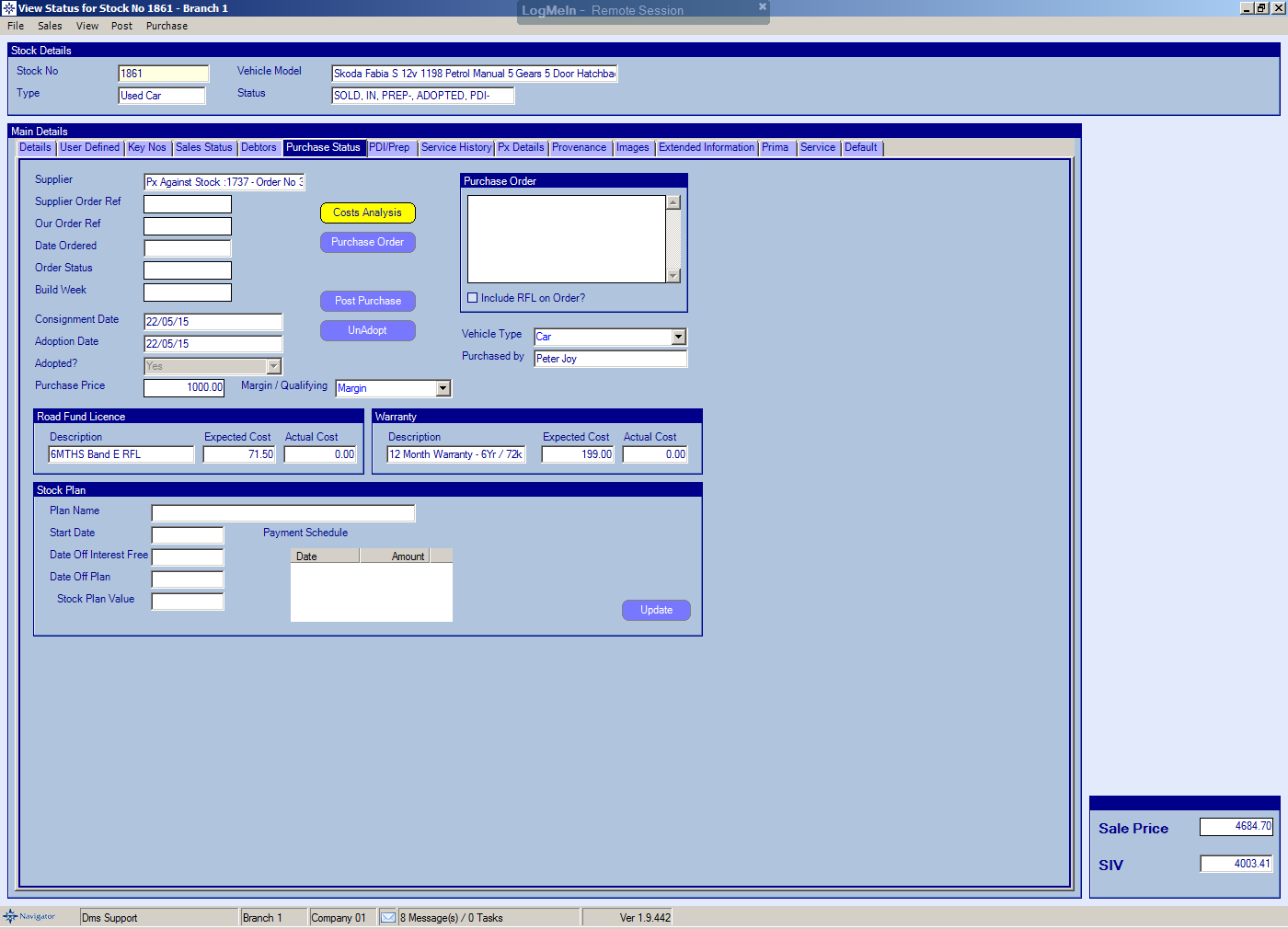

The Stock Record is shown below:

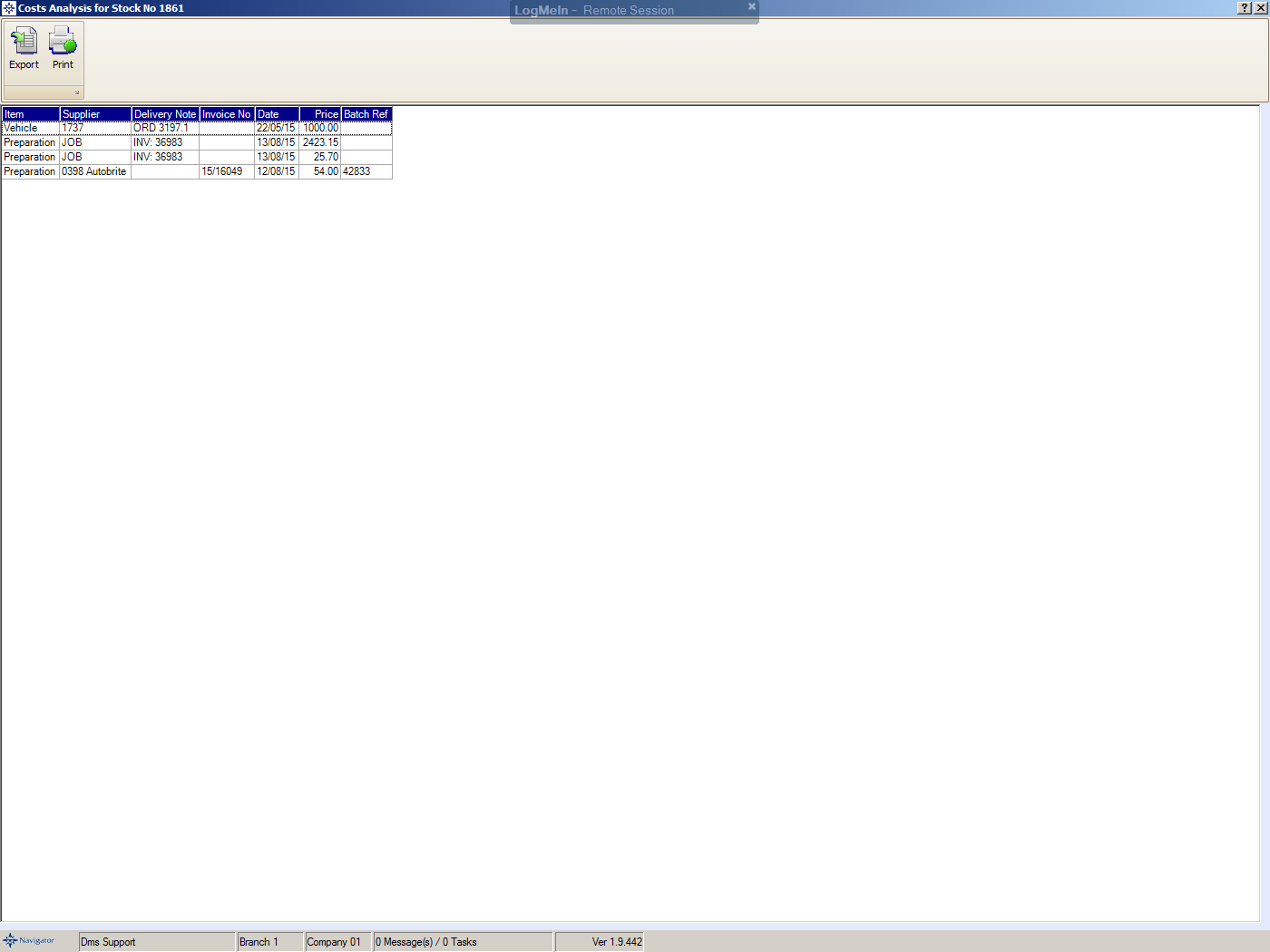

The Cost Analysis shows how the accounting SIV is made up:

The workings out for the total value of the SIV are:

Actual value of the SIV:

Vehicle Purchase : 1000.00

Prep : 2423.15

25.70

54.00

----------

Total SIV 3502.85

It would seem logical that we would not lose money if the vehicle was sold for £3502.85 - the price we have paid for it plus the cost of preparation. However, if we did sell this vehicle for £3502.85, we would incur a VAT liability under the margin scheme of : £414.14 (20% of the 2502.85 profit we have made for VAT purposes) which would mean that we only retain £3088.72 and show a loss of £414.14

We can't even simply add this VAT into the Sale price. If we sold the vehicle for £3502.85 + £414.14 = £3916.99 we would then incur a VAT liability of £652.83 and still have a loss of £238.69!

It turns out that the SIV shown on screen - £4003.41 is the lowest sale price where no money is lost as part of the sale. The margin vat in this case is £500.56 leaving a profit of zero!

For Qualifying Vehicles, the SIV includes VAT.