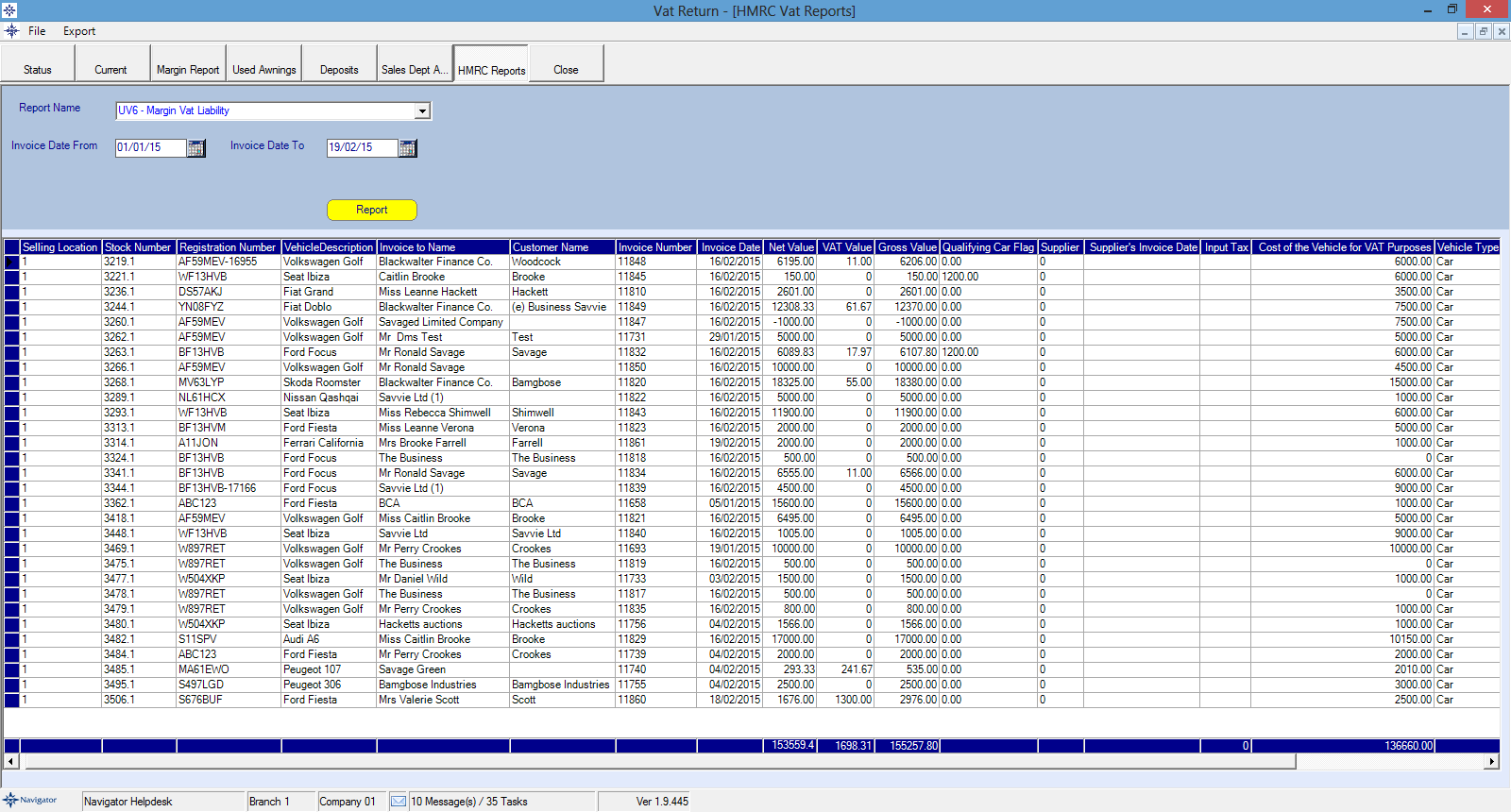

Purpose of Report:

To identify possible liability/VAT coding errors with the sales of non-qualifying (margin scheme) vehicles. Note - this report may duplicate some of the transactions identified using report UV5.

Associated Risks:

•Incorrect VAT coding used when vehicle sold.

•Vehicles supplied on Hire Purchase are supplied to a finance company and are not zero-rated for VAT.

•Do you have evidence that the vehicle has been exported?

•Has the vehicle been specifically and permanently adapted for a disabled person? Do you have a completed certificate signed by the disabled person? Are you satisfied that the vehicle is supplied for the personal use of the disabled person? Note - supplies to businesses cannot be zero-rated.

•The vehicle may have been supplied inter-group outside the scope of VAT. In which case the ultimate margin may have been incorrectly inflated/deflated bu profits made when the vehicles transferred to/from other dealerships within the same VAT registration number.