Introduction

Occasionally, it is possible that the Nominal Ledger postings relating to a stock record are not correct. This may be highlighted as an imbalance in the Nominal Ledger Reconciliation or discovered at the end of the month when reviewing the Vehicle Sales Suspense Nominal Code.

Reconciliation

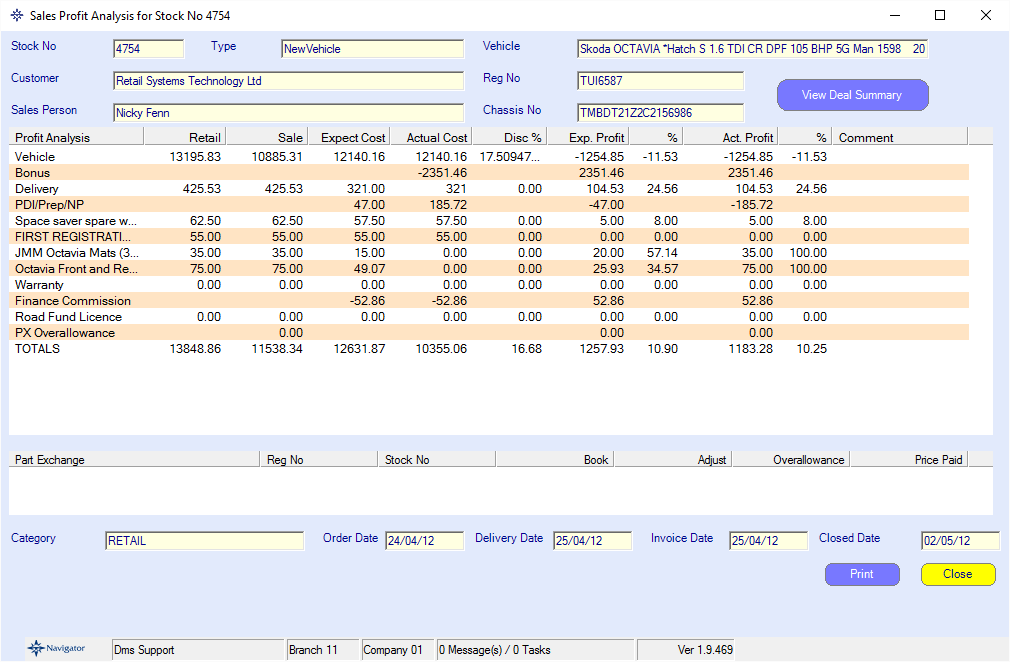

Before reviewing the actual nominal ledger transactions, review the stock record itself. In particular review the Sales Profit Analysis available clicking “Profit” on the Sales Status tab of the vehicle :-

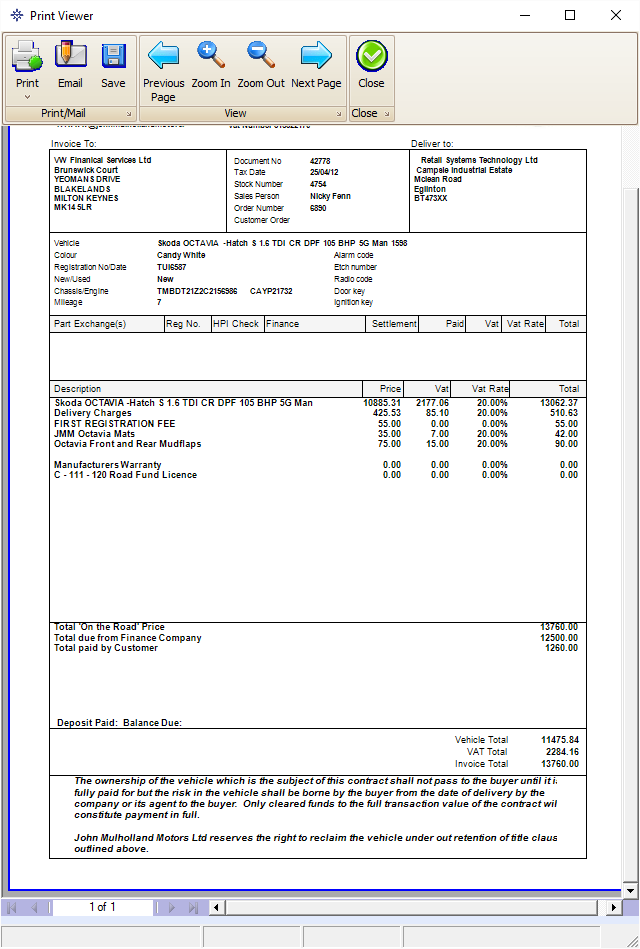

In addition view the final set of invoices (the main invoice, plus any split invoices and supplementaries) – these can be reviewed using the “Print Invoice Option” on the vehicle Sales Status tab:-

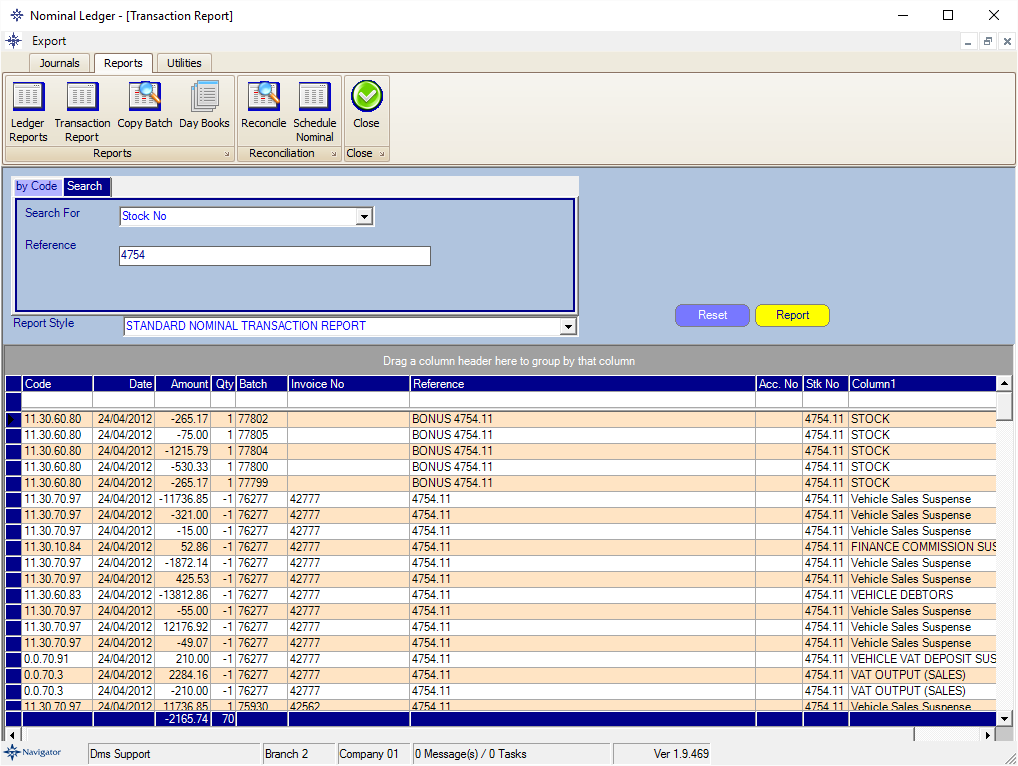

Then review the nominal ledger transactions relating to the stock record. Do this in Nominal Ledger > Reports > Transaction Report. Click on the “Search” tab, and then change the search to being on stock no. Enter the stock no and click “Report” :-

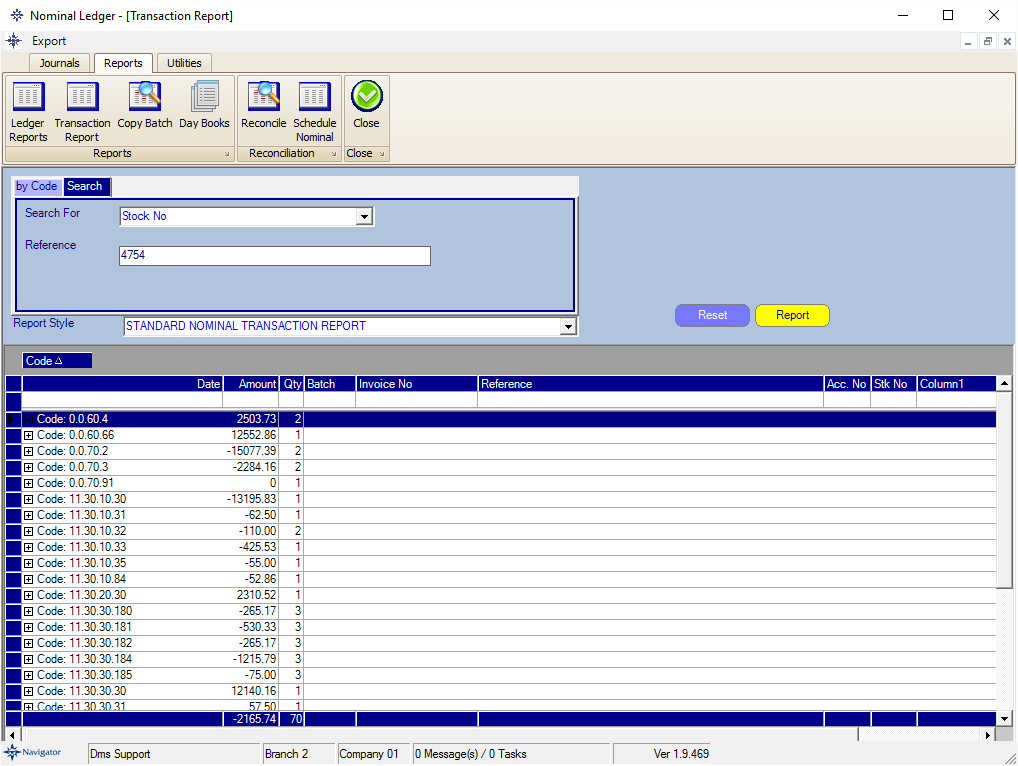

Drag the “Code” column up into the dark grey area above the headings to provide a summary by nominal code :-

This will then display the nominal analysis which can then be reviewed.

Reviewing and Reconciling the Nominal Transactions

Firstly, review the Balance Sheet accounts, looking at the following nominal codes :-

x.3y.60.80 – this is the stock value of the vehicle. If the vehicle is closed deal then this should be zero.

x.3y.60.83 – this is the debtors account for the vehicle – this should equal the value of the debt on the vehicle shown on the stock record plus the outstanding finance commission.

0.0.70.87 – Settlement Suspense. This should only hold the expected settlement up until the settlement is paid. Once it has been paid, it should be zero.

x.3t.70.97 – this is the Sales Suspense account – it should equal the invoice value less vat whilst the deal is open and be zero once closed.

0.0.70.3 – this is the vat output account which should be the total of the VAT shown on the bottom of all sales invoices plus the margin VAT shown on the Profit Analysis on the deal.

0.0.70.91 – this is the VAT suspense account relating to deposits on the deal. It should be zero once the vehicle is invoiced.

x.3y.10.z – each of the sales lines should add up to a line on the “Retail Column” on the Sales Analysis Report

x.3y.20.z – These are values of discount given, and should be the difference between the invoice value (before vat) of each line on the sales invoice and the retail value shown on the Sales Analysis Report.

X.3y.23.30 - this is the Part Exchange Overallowance, and should match with the figure shown on the Sales Analysis.

The above accounts may be also be duplicated for other nominal codes relating to Dealer Options – you can see the nominal codes involved on the Sales Analysis Report (In brackets at the end of the description of the option).

x.3y.30.z – this is the cost of sale and should match line by line with the Sales Analysis Report.

x.3y.30.z – Where “z” is greater than 100 and is not already referenced by a dealer accessory line are related to bonuses, and should match the bonuses shown on the sales analysis.

Generally, if there are any differences there are debits and credits required within the deal which will come to zero and allow a journal to be processed to correct. When carrying out a nominal journal to any of these accounts, it is good practice to enter the stock no on each line in the “Stock No” box as you post. The stock no in this context includes a .br eg “.1” for branch 1 at the end of the stock no.

Using the above guidelines it should be straightforward to review and correct most nominal ledger related issues with stock nos.

As usual, if you have an issue with reconciliation that you are unable to resolve, then please do not hesitate to contact the Navigator Helpdesk